Everyone Has Hobbies. Here’s How to Tax Deduct Yours.

Some hobbies are more expensive than others. Eating out, traveling, owning classic cars, breeding horses, and boating are much more expensive that reading, watching TV, hiking, or clipping coupons.

If you have an expensive hobby, you can make it that much more enjoyable by making it TAX DEDUCTIBLE. Hobby losses are not deductible, but business losses are. So you make your hobby tax deductible by turning it into a business.

The IRS spells out the difference between a hobby and a business in Fact Sheet 2007-18 which you can read at: http://www.irs.gov/newsroom/article/0,,id=169490,00.html.

Generally, an activity qualifies as a business if it is carried on with the reasonable expectation of earning a profit. Note the use of the word “expectation.” You do not have to actually make a profit, just expect one. Someday.

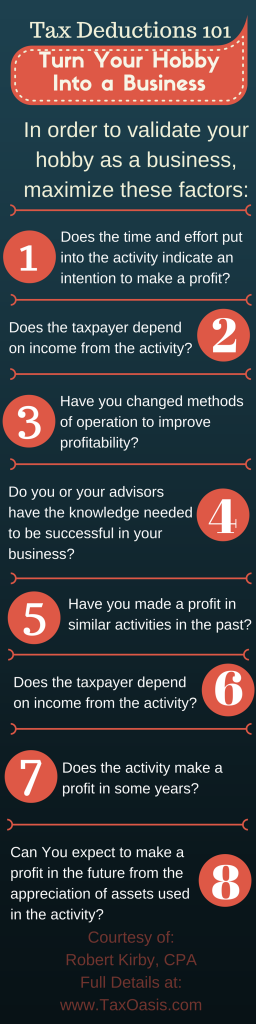

In order to validate your profit expectation, you should score as high as possible on the following factors:

To reduce the likelihood that the IRS audits your hobby, you should also consider forming a partnership or corporation, which are much less likely to come under examination.

To show you how this can work for you, I will tell you the story of Barry (not his real name) who was one of our clients. His hobby was photography, and he was particularly fond to going to race venues on the day before the race, which is usually open to the public for free, most of the drivers are present, and there are lots of opportunities for pictures.

One year, when grumbling about owing the IRS, Barry asked if there was anything else he could deduct. So we asked him what he spent his money on – and he told us what he spent per year on the racing photos. With a little coaching, Barry left our office with a business plan, ordered business cards, ran an ad in Race and Driver Magazine, and was now running Barry’s Race Photography business. Barry figured he might have to spend an a little extra each year to qualify his hobby as a business and be able to use his deductions. The next year he was eager to have his taxes prepared, and rightly so, since the deductions from BRP snared him a sizable tax refund! All perfectly legal.

Do you have a hobby? Would you like to get a business deduction? Give us a call and we’ll show you how to get started.